Liquidity is the lifeblood of financial markets, ensuring assets can be swiftly bought and sold without drastic price fluctuations. In this article, we explore three different types of liquidity—trading liquidity, RWA/STO liquidity, and the decreasing involvement of venture capital (VC) in startups since 2022—and examine their benefits, current challenges, and potential solutions related to market volume and capital flow.

Trading Liquidity

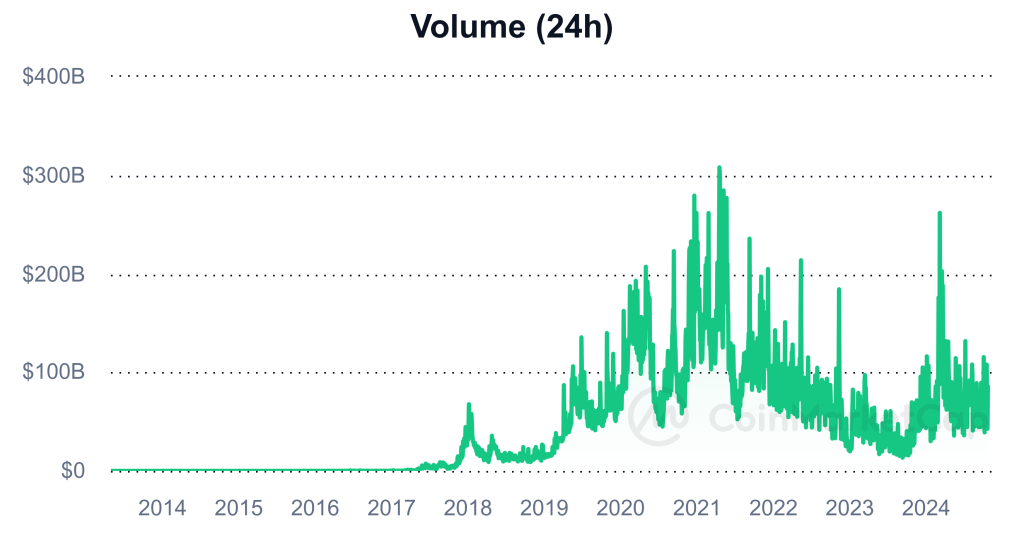

Trading liquidity refers to the ability of assets—such as stocks, bonds, or cryptocurrencies—to be traded quickly without significant changes in their market price. Highly liquid assets like Bitcoin, Ethereum, and major tech stocks are supported by high trading volumes, ensuring market stability and reducing the risk of abrupt price fluctuations. For example, in 2021, trading volumes were particularly high in the crypto market as significant capital inflows pushed prices up. However, by 2024, even though Bitcoin hit its highest price levels, overall trading volume in the crypto market was significantly lower, reflecting lower liquidity and creating a more volatile environment.

It is important to note that volume does not equal liquidity; instead, volume is often a byproduct of market depth, as participants are more confident executing trades in a deeper market. While volume is a useful and simple indicator of market activity, it is not a direct driver of liquidity. Liquidity is more closely tied to the availability of buy and sell orders across price levels, ensuring that large trades can be executed without significantly affecting the market price.

The drop in trading volume presents serious challenges for liquidity. When fewer participants are actively trading, price movements become more pronounced, leading to increased volatility and unpredictability. This has been especially evident in thinly traded crypto markets, where a lack of capital inflows has contributed to sharp price swings and reduced investor confidence.

Addressing this challenge requires a focus on restoring trading volume and capital inflows into the markets. A key factor in improving liquidity is bringing more capital into the market through incentives that attract both institutional and retail investors. In 2021, we saw how higher trading volume was directly correlated with improved liquidity, but that volume was largely driven by speculative capital. By 2024, the focus must shift to sustainable capital flows, driven by clearer regulatory frameworks that reduce uncertainty and encourage long-term investments. Increasing institutional participation and boosting the availability of liquidity pools could ensure a more stable influx of capital, helping markets recover from periods of low volume and liquidity.

RWA/STO Liquidity (Real-World Assets/Security Token Offerings)

RWA/STO liquidity revolves around the tokenization of real-world assets such as real estate or equity. By creating digital tokens that represent ownership in these traditionally illiquid assets, RWA/STO liquidity aims to open up investment opportunities for a broader range of investors. This form of liquidity thrives when there is a sufficient volume of capital flowing into tokenized assets. For example, when capital markets are flush with funds, investors are more likely to experiment with new financial products like security tokens – divided into the private and public asset.

One of the main challenges for RWA/STO liquidity is that without significant market adoption, trading volumes remain low, which limits liquidity and keeps these markets from reaching their full potential. While the regulatory guidelines have been helpful in some jurisdictions, these frameworks have not been put to test; black swan, defaults. For example, with the blow up of FTX and dominos effects on several institutions, Bitcoin has proven its weight as a real asset class and is here to stay.

The sustainability of this liquidity type depends heavily on increased market participation, injection of fresh capital and market conditions. Encouraging larger institutional investors to allocate capital to tokenized assets could drive up the volume of trades and increase liquidity. A rise in capital inflows would lead to higher trading volumes, which, in turn, would make tokenized assets more liquid and widely traded. The success of security tokens hinges on the market’s ability to draw in substantial capital from a broader range of investors, creating a self-sustaining cycle of liquidity.

Equally important, if not more so, is the role of liquidity pools in RWA/STO markets. They can accept high-grade collateral, providing greater security and trust in the system. The seamless transfer of assets within these pools enhances operational efficiency, while legal protections embedded within smart contracts ensure that the assets and investors are safeguarded. By leveraging liquidity pools, tokenized assets can achieve higher levels of liquidity, acceptance, and stability, reinforcing the overall robustness of the RWA/STO market.

VC Liquidity Post-2022

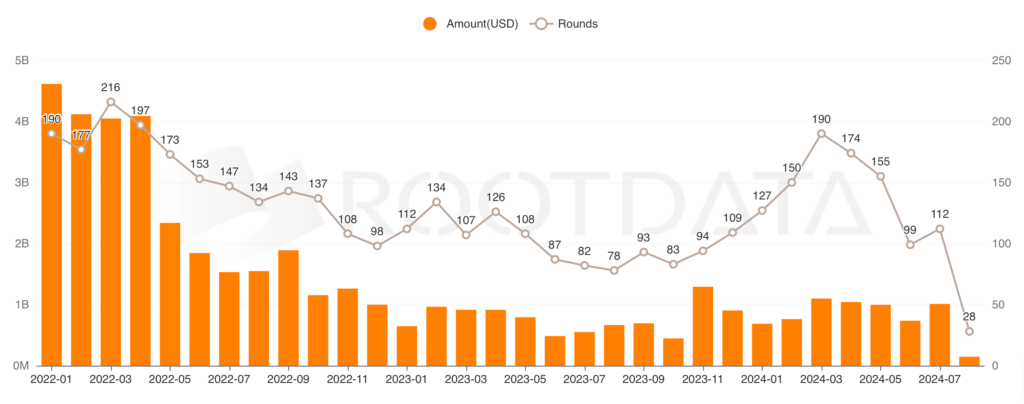

Venture capital liquidity, historically a key driver of startup innovation, refers to the flow of capital into high-risk ventures. Since 2022, there has been a sharp decrease in VC involvement, particularly in crypto-related projects. Many VCs are now hesitant to fund projects in the crypto space as the focus has shifted heavily toward trends or memes. These projects, often termed “memecoins,” have seen a rise in popularity, but lack the fundamental innovation that VCs typically seek. Coins like Dogwifhat, Pepe Wif Hat, and Popcat have managed to break out and show results despite limited funding, leveraging viral internet culture rather than robust technological advancements or business models.

The decline in VC funding for more traditional and innovative crypto projects has had a profound effect on liquidity in the space. In 2022, venture capital funding for the crypto market was significantly higher, with over $4 billion flowing into the market each month during the first four months of the year. In contrast, by 2024, crypto venture capital funding had exceeded $1 billion in only three months: March ($1.09 billion), April ($1.04 billion), and July ($1.01 billion). This stark reduction in capital inflows has made it much harder for promising projects to secure funding, which, in turn, limits liquidity and overall market growth. Startups are increasingly struggling to get off the ground, as the focus of VCs has shifted away from substantial technological innovation toward safer bets or meme-driven trends with viral potential.

The primary challenge here is the significant reduction in capital inflows. When fewer venture capital firms are willing to fund high-potential projects, the overall liquidity in the startup and crypto ecosystems suffers. This scarcity of capital is further exacerbated by the fact that the money that does flow into the market is often directed toward speculative or meme-driven projects, rather than long-term, value-driven initiatives. As a result, many startups are forced to focus on profitability and self-sustainability, which stifles the innovation needed to fuel future growth in the sector.

To address the liquidity gap, efforts must focus on restoring the flow of capital into more promising crypto ventures and other high-risk startup projects.

Conclusion: Solving the Challenges Across All Three

Solving the liquidity challenges in these 3 verticals requires a concerted effort to increase the volume of capital flowing through these systems. Increasing market participation and attracting sustainable capital inflows are crucial across all sectors. In trading liquidity, clearer regulations can reverse declining volumes and stabilize markets. For RWA/STO liquidity, larger institutional investments are needed to scale the market and ensure long-term liquidity. In VC liquidity, alternative funding methods like crowdfunding and institutional backing can diversify capital sources and support ongoing innovation. By addressing the issue of capital volume across these different types of liquidity, markets can become more stable and resilient, ensuring future growth.

I’m Sean Lim and this is a bull market.

Referencing

Graph 1 – Volume 24h (Source: Coinmarketcap)

Graph 2 – Venture Capital Funding 2022 – Present (Source: Cointelegraph)